Income Tax Refund Under Which Head In Tally . If entry will be , income. replied 03 may 2011. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. I want to know what should be the accounting entry in my company books? If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. hello i want to pass an entry in tally for tncome tax refund which i received. I have created ledger 'incometax refund' but what group should it be under??

from www.youtube.com

If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. I have created ledger 'incometax refund' but what group should it be under?? I want to know what should be the accounting entry in my company books? If entry will be , income. replied 03 may 2011. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. hello i want to pass an entry in tally for tncome tax refund which i received.

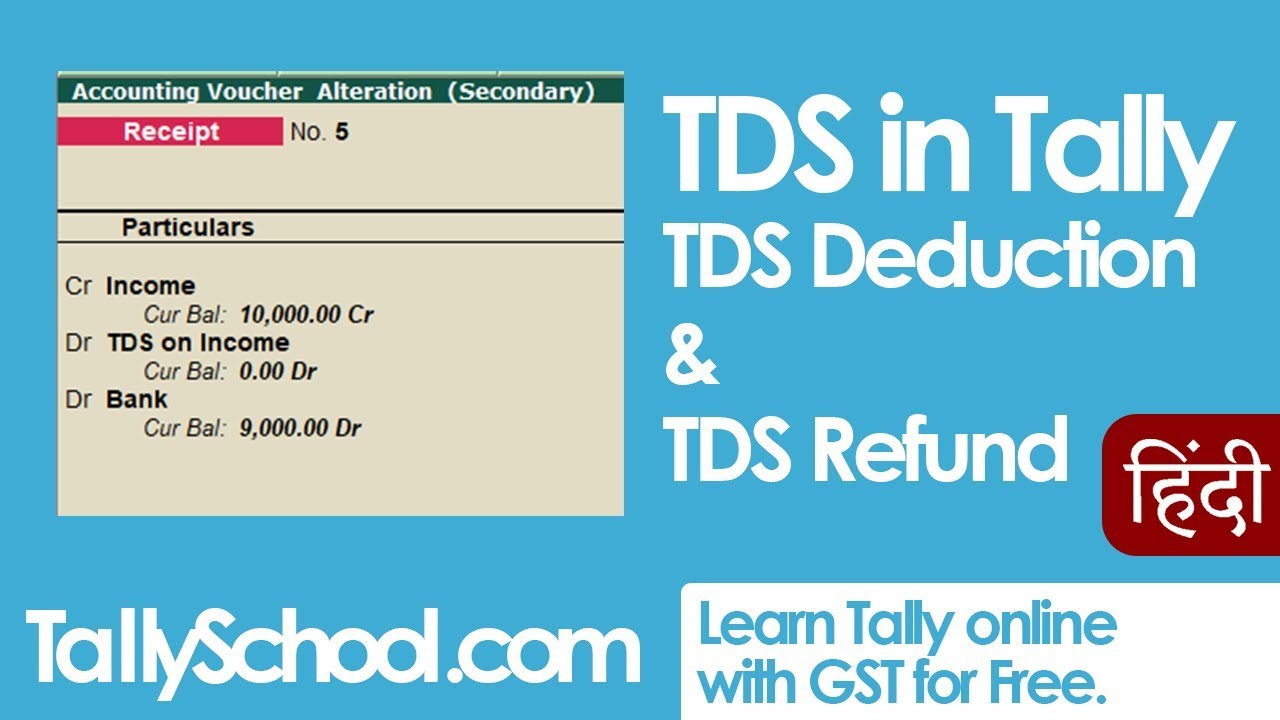

TDS in Tally TDS Deduction & Refund Entries in Tally YouTube

Income Tax Refund Under Which Head In Tally hello i want to pass an entry in tally for tncome tax refund which i received. hello i want to pass an entry in tally for tncome tax refund which i received. replied 03 may 2011. I want to know what should be the accounting entry in my company books? I have created ledger 'incometax refund' but what group should it be under?? If entry will be , income. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax.

From help.tallysolutions.com

How to View Tax Computation Report in TallyPrime (Payroll Income Tax Refund Under Which Head In Tally I have created ledger 'incometax refund' but what group should it be under?? If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. I want to know what should be the accounting entry in my company books? income tax a/c dr (expense). Income Tax Refund Under Which Head In Tally.

From help.tallysolutions.com

How to Configure Tax Components in TallyPrime TallyHelp Income Tax Refund Under Which Head In Tally If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. replied 03 may 2011. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of. Income Tax Refund Under Which Head In Tally.

From www.tallyknowledge.com

How to do Reverse Charge entry in Tally.ERP9 under GST? Tally Knowledge Income Tax Refund Under Which Head In Tally hello i want to pass an entry in tally for tncome tax refund which i received. If entry will be , income. I have created ledger 'incometax refund' but what group should it be under?? income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax). Income Tax Refund Under Which Head In Tally.

From help.tallysolutions.com

How to Record Refund of Input Tax (VAT) In TallyPrime TallyHelp Income Tax Refund Under Which Head In Tally I want to know what should be the accounting entry in my company books? replied 03 may 2011. If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. If entry will be , income. hello i want to pass an entry. Income Tax Refund Under Which Head In Tally.

From www.youtube.com

Professional Tax in Tally ERP9, Payment of professional Tax YouTube Income Tax Refund Under Which Head In Tally replied 03 may 2011. hello i want to pass an entry in tally for tncome tax refund which i received. If entry will be , income. I have created ledger 'incometax refund' but what group should it be under?? income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash. Income Tax Refund Under Which Head In Tally.

From www.patriotsoftware.com

Journal Entry for Tax Refund How to Record Income Tax Refund Under Which Head In Tally If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. I want to know what should be the accounting entry in my company books? hello i want to pass an entry in tally for tncome tax refund which i received. income. Income Tax Refund Under Which Head In Tally.

From help.tallysolutions.com

How to Configure Tax Components in TallyPrime TallyHelp Income Tax Refund Under Which Head In Tally replied 03 may 2011. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. I have created ledger 'incometax refund' but what group should it be under?? If income tax refund is received for any year then the books. Income Tax Refund Under Which Head In Tally.

From www.youtube.com

Advance Tax Entry in Tally Prime Tally Prime Learn to Win YouTube Income Tax Refund Under Which Head In Tally income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. hello i want to pass an entry in tally for tncome tax refund which i received. I have created ledger 'incometax refund' but what group should it be under??. Income Tax Refund Under Which Head In Tally.

From exorowyqe.blob.core.windows.net

Tax Refund Receipt Entry In Tally at Betty McDermott blog Income Tax Refund Under Which Head In Tally I want to know what should be the accounting entry in my company books? replied 03 may 2011. I have created ledger 'incometax refund' but what group should it be under?? hello i want to pass an entry in tally for tncome tax refund which i received. If income tax refund is received for any year then the. Income Tax Refund Under Which Head In Tally.

From www.svtuition.org

How to Pass TDS Voucher Entries Under GST in Tally.ERP 9 Accounting Income Tax Refund Under Which Head In Tally If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. replied 03 may 2011. I have created ledger 'incometax refund' but what group should it be under?? I want to know what should be the accounting entry in my company books? . Income Tax Refund Under Which Head In Tally.

From www.youtube.com

Tax in Tally.ERP 9 YouTube Income Tax Refund Under Which Head In Tally hello i want to pass an entry in tally for tncome tax refund which i received. I have created ledger 'incometax refund' but what group should it be under?? If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. If entry will. Income Tax Refund Under Which Head In Tally.

From www.teachoo.com

Tally Ledger Groups List (Ledger under Which Head or Group in Accounts Income Tax Refund Under Which Head In Tally If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. I have created. Income Tax Refund Under Which Head In Tally.

From www.youtube.com

Interest on Tax Refund Entry in Tally Interest on IT Refund Income Tax Refund Under Which Head In Tally income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. replied 03 may 2011. If entry will be , income. I want to know what should be the accounting entry in my company books? If income tax refund is. Income Tax Refund Under Which Head In Tally.

From dxovuydxn.blob.core.windows.net

Tax Refund Journal Entry In Tally at James Crowe blog Income Tax Refund Under Which Head In Tally I want to know what should be the accounting entry in my company books? If entry will be , income. If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. I have created ledger 'incometax refund' but what group should it be under??. Income Tax Refund Under Which Head In Tally.

From www.teachoo.com

Tally Ledger Groups List (Ledger under Which Head or Group in Accounts Income Tax Refund Under Which Head In Tally I have created ledger 'incometax refund' but what group should it be under?? I want to know what should be the accounting entry in my company books? replied 03 may 2011. If entry will be , income. hello i want to pass an entry in tally for tncome tax refund which i received. income tax a/c dr. Income Tax Refund Under Which Head In Tally.

From www.youtube.com

TDS in Tally TDS Deduction & Refund Entries in Tally YouTube Income Tax Refund Under Which Head In Tally income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so in case of refund entry. If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. replied 03. Income Tax Refund Under Which Head In Tally.

From khatabook.com

How To Manage Mutual Fund Accounting In Tally Erp 9 Income Tax Refund Under Which Head In Tally replied 03 may 2011. If income tax refund is received for any year then the books of accounts for that particular year would have been closed by creating a income tax. hello i want to pass an entry in tally for tncome tax refund which i received. income tax a/c dr (expense) (charge to p&l) to advance. Income Tax Refund Under Which Head In Tally.

From www.youtube.com

How to file tax return in tally erp 9? YouTube Income Tax Refund Under Which Head In Tally I have created ledger 'incometax refund' but what group should it be under?? hello i want to pass an entry in tally for tncome tax refund which i received. replied 03 may 2011. income tax a/c dr (expense) (charge to p&l) to advance tax paid a/c (if any paid) to bank/cash a/c (balance self assmt tax) so. Income Tax Refund Under Which Head In Tally.